Max You Can Put In Hsa 2025

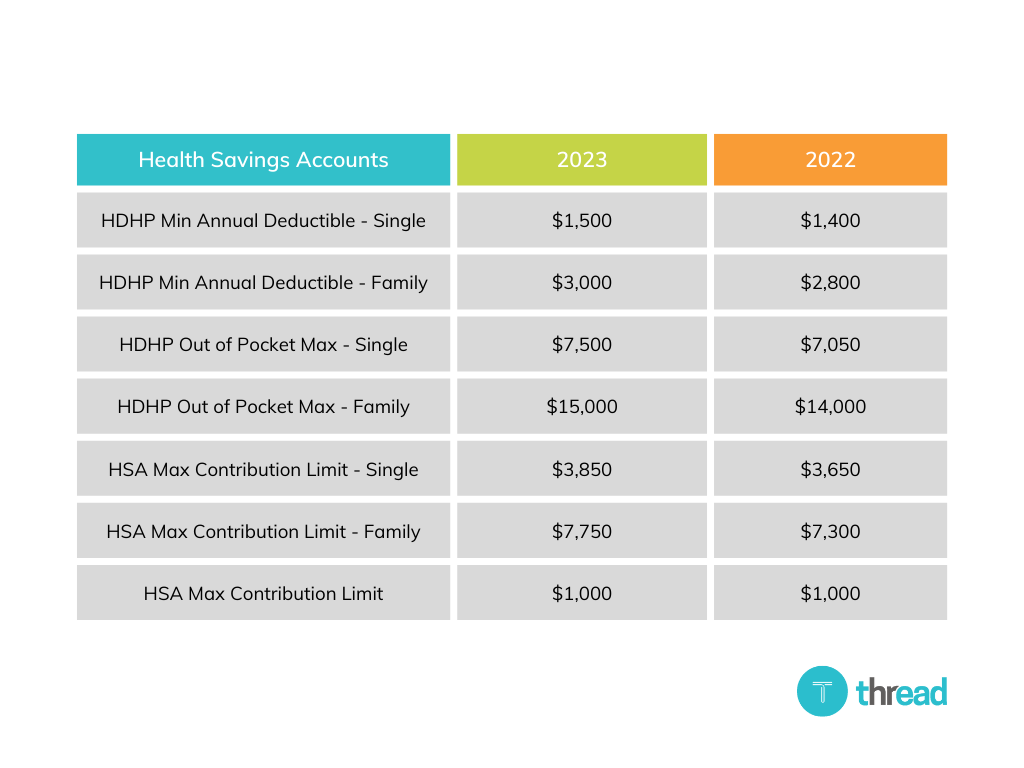

Max You Can Put In Hsa 2025 - Tabela Atualizado Irs 2025 Hsa Limit IMAGESEE, Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families. Here are the maximum amounts you can contribute to an hsa in 2025: 3 ways to boost HSA participation Employee Benefit News, $3,850 single coverage $7,750 family coverage. If you're under 55, your 2025 contribution limit is:

Tabela Atualizado Irs 2025 Hsa Limit IMAGESEE, Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families. Here are the maximum amounts you can contribute to an hsa in 2025:

Max You Can Put In Hsa 2025. In 2025, here's how much you can put into an hsa (and deduct from your income on your tax return) based on whether you're single or have family health. Introducing the new hsa limits.

But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.

7 Purchases You May Not Know You Can Make With Your HSA Fund, If you're under 55, your 2025 contribution limit is: (people 55 and older can stash away an.

Hsa members can contribute up to the annual maximum amount that is set by the irs.

Right now, hsas max out at $3,850 for individuals and $7,750 for families.

2025 Hsa Max Over 55 Else Nollie, If you're under 55, your 2025 contribution limit is: The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

You can put your untouched FSA/HSA dollars toward new prescription, The federal government limits who can open an hsa, how much you can contribute, what you can use the. In 2025, these limits will rise to $4,150 and $8,300,.

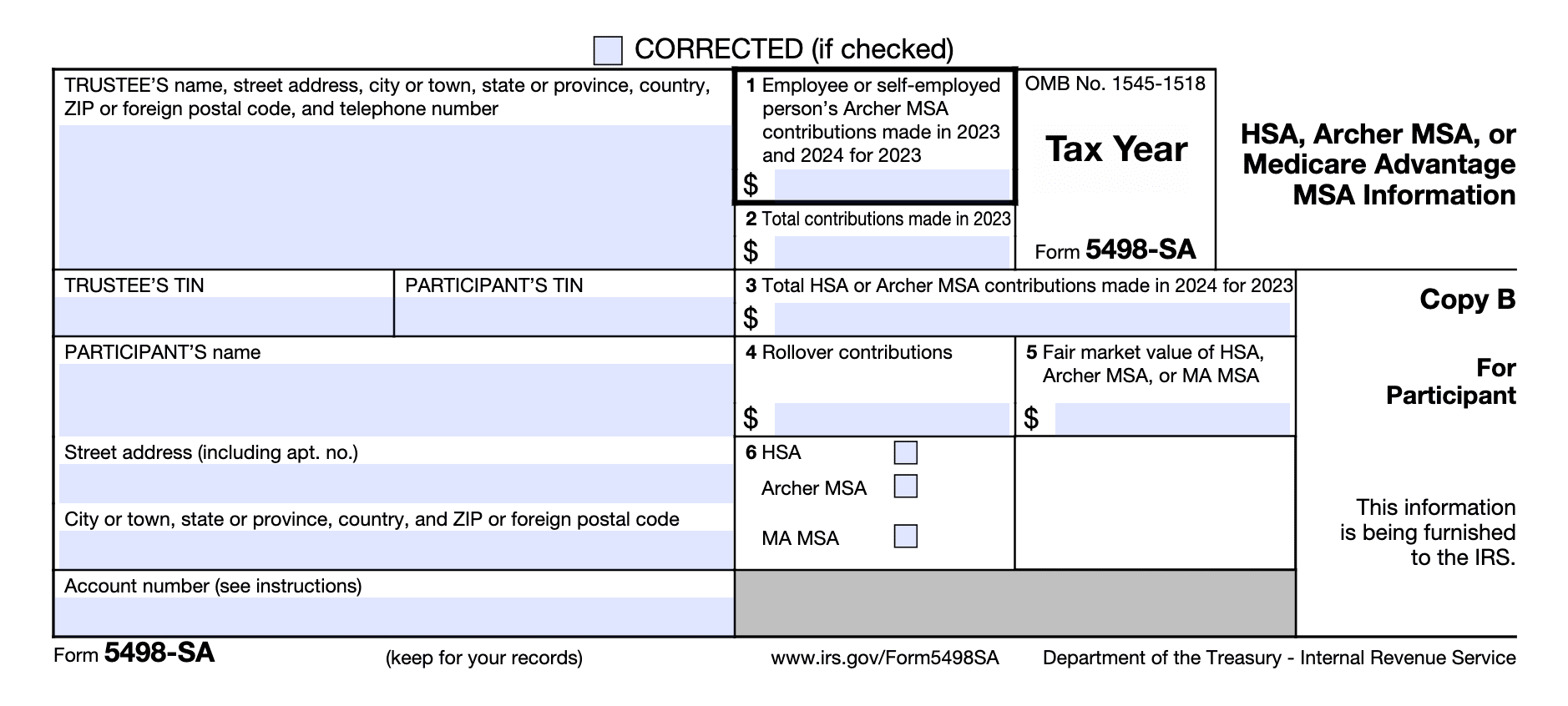

How HSA Distributions and Contributions Affect Your Tax Return, For the 2025 tax year, you can contribute up to $3,850 to an hsa if you have an eligible hdhp and are the only one on it. $4,150 (+$300 over prior year) family plan:

Balancing 401(k) and HSA Pretax Contributions First Citizens, Hsa members can contribute up to the annual maximum amount that is set by the irs. The health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years.

What Is The Max Hsa Contribution For 2022 2022 JWG, For 2025, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2025. If you're under 55, your 2025 contribution limit is:

Significant HSA Contribution Limit Increase for 2025, The new 2025 contribution limits for health savings accounts are $4,150 for individuals or $8,300 for families. (people 55 and older can stash away an.

The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

Must Know Irs Hsa Limits 2025 For You 2025 BGH, Making the maximum contribution to your hsa in 2025. Introducing the new hsa limits.